tax per mile rate

Flatbed rates are at 314 per mile. First 10000 miles Above 10000 miles.

Irs Raises Standard Mileage Rate For 2022

Pennsylvania which has the third highest gas tax rate in the country.

. May 24 2022. 4p per mile for fully electric cars. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate for 2020 and.

Democratic lawmakers recently sent a letter to IRS Commissioner Charles Rettig asking the IRS for a midyear increase in the 2022 optional standard mileage rate due to the steep rise in gas prices. Someone driving about 11500 miles a year would pay about 207. The rate where the columns intersect is the tax rate in mills 110 of 1 cent.

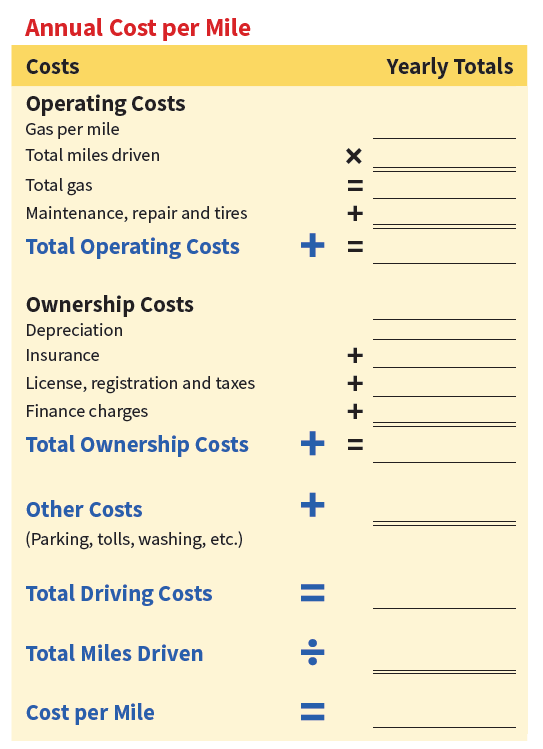

Medical and moving mileage rate. For automobiles a taxpayer uses for business purposes the portion of the business standard mileage rate treated as depreciation is 25 cents per mile for 2018 26 cents per mile for 2019 27 cents. You can deduct 15 of your total vehicle-related expenses per year on your tax return.

What Mileage is Tax Deductible. 5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work journeys for them. Keep in mind that these are just averages and your business may profit from a different rate.

The current rate taxpayers can use to deduct the cost of operating an automobile for business purposes in 2022 is 585 cents per mile. In reality the vehicle mileage tax program that is included in the infrastructure bill proposes a three-year pilot program to study the viability of a road user charge. Pickups SUVs and cargo vans average 257 miles per gallon meaning that an 81 cent per mile tax on the average 2020 car would be equivalent to a gas tax of 208 per gallonalmost four times the current state rate of 587 cents per gallon.

Deductible business miles include driving to work-related functions meeting clients and going to job sites. 15 rows Find optional standard mileage rates to calculate the deductible cost of operating a vehicle for. Instead a portion of the rate is applied equaling 26 cents-per-mile for 2021 down one cent from 2020.

As well as the 575 cents for business miles driven there are other types of mileage that are also tax-deductible. The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan. Unlike the standard mileage rate the actual expense method takes some number-crunching in order to.

The standard rate for medical and moving purposes is based on the variable costs as determined by the same study. 45p 40p before 2011 to 2012 25p. Cars and vans mileage rate.

Charitable service mileage rate. Pennsylvania which has the highest fuel tax in the nation at 587 cents per gallon recently began discussions on whether or not an 81-cent-per-mile tax was appropriatethis would translate. Average Tax Rate per Mile.

What is the standard mileage rate. Taxable miles in Oregon includes all miles driven in Oregon on roads accessible to the public. Reefer rates are 319 per mile.

That is up about 45 from the 2021 rate of 56 cents per mile. The standard mileage rate for medical miles is 17 cents. Convert the mill rate to dollars per mile see examples below the chart.

Standard Mileage Rate for Business. The HMRC-approved mileage rate for cars and vans is set at 045 per mile when driven under 10000 miles per year. Providing the lowest rates may not be enough to bring your revenue but a rate thats too.

American drivers could soon trade paying taxes on gas at the pump for owing the government annual per-mile user fees under a new pilot program recently passed by the Senate in Joe Biden s 12. The mileage rates set by HMRC is set at a rate per mile that contributes to the cost of wear and tear on a vehicle as well as fuel MOT. Lets say that in the last year youve driven 16000 miles for work purposes.

45 pence per mile for cars and goods vehicles on the first 10000 miles travelled 25 pence over 10000 miles 24 pence per mile for motorcycles. These are for medical miles driven and miles driven during charity work. Business mileage rate.

If the vehicle is used for more the employee receives 025 per mile above that 10000 threshold. For the current tax year you can claim the standard mileage rate of 575 cents for every business mile driven. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

The rate for business travel expenses has dropped from 575 cents per mile in the 2020 tax year to 56 cents per mile for 2021. The current mileage allowance rates 20212022 tax year. With the correct number of axles.

Oregons tax rate of 18 cents per mile is equivalent to the 36-cent gas tax paid by a vehicle that gets 20 miles per gallon. Multiply your Oregon taxable miles times the rate to calculate the amount of tax due. Multiply your Oregon taxable miles times the rate to.

Users are expressing concerns about the cost of driving and incorrectly stating that it would cost drivers 8 cents a mile per a USA Today story. With the correct number of axles. The rate where the columns intersect is the tax rate in mills 110 of 1 cent.

Convert the mill rate to dollars per mile see examples below the chart. The IRS announced that beginning January 1 2022 the standard mileage rate for the use of a car will be 585 cents per mile. The standard mileage rate for business is based on an annual study of the fixed and variable costs of operating an automobile.

Motor Fuel Taxes Urban Institute

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

How Do State And Local Sales Taxes Work Tax Policy Center

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Claiming Vat On Mileage Expenses Tripcatcher

Mileage Reimbursement Calculator

Aaa S Your Driving Costs Aaa Exchange

2021 Mileage Reimbursement Calculator

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

States With Highest And Lowest Sales Tax Rates

What Are The Mileage Deduction Rules H R Block

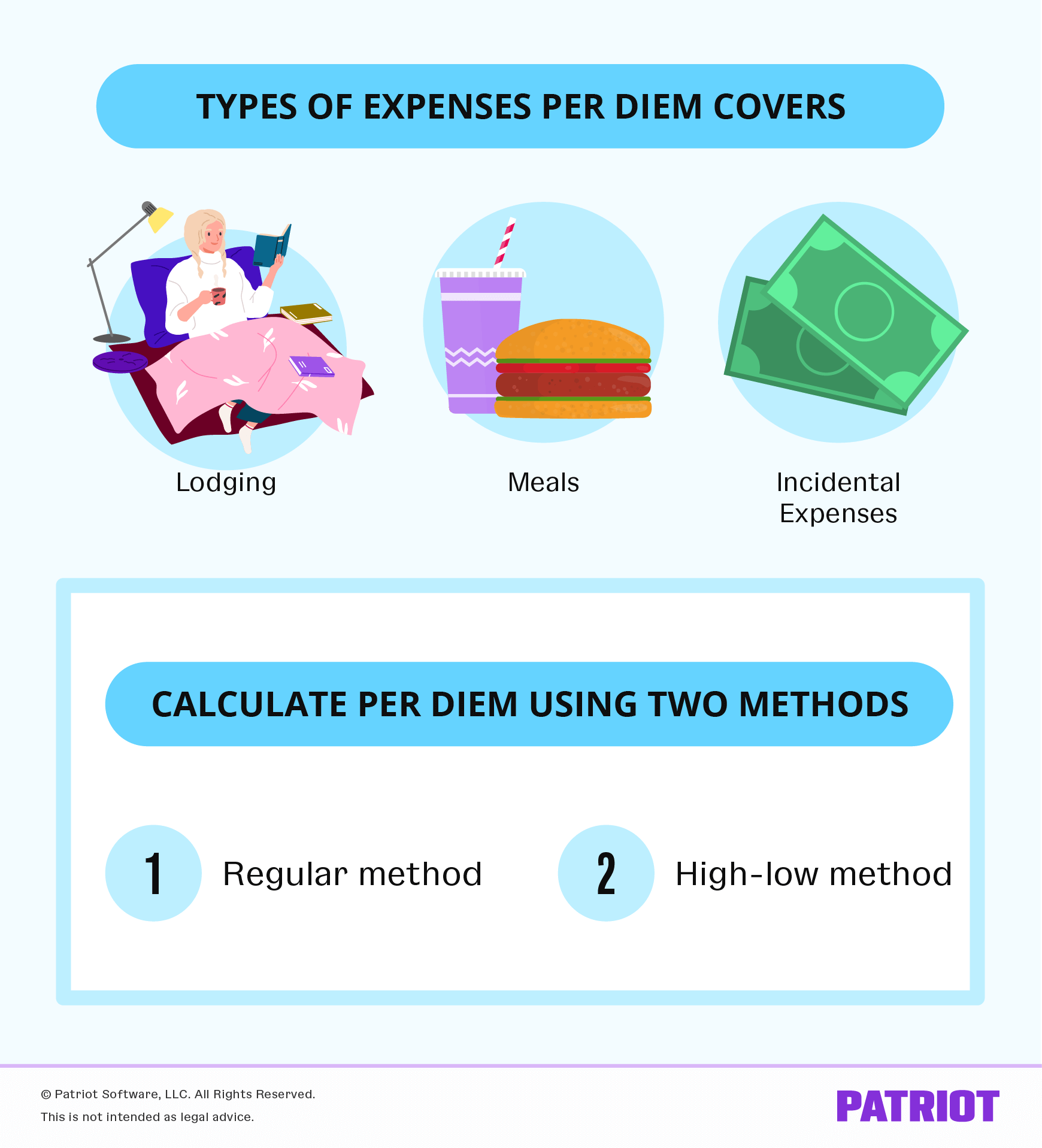

What Is Per Diem Definition Types Of Expenses More

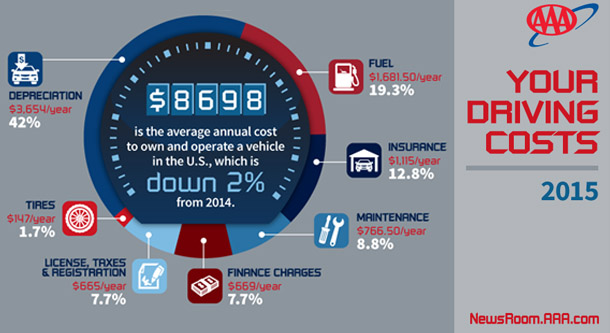

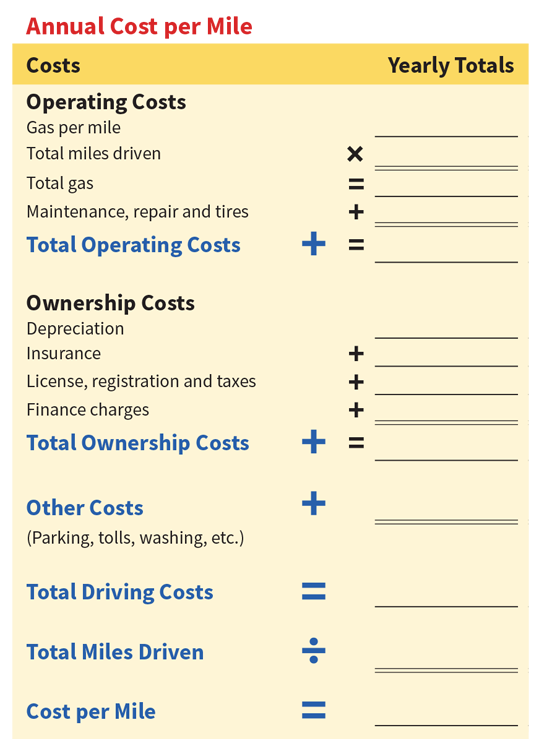

Annual Cost To Own And Operate A Vehicle Falls To 8 698 Finds Aaa 2015 Your Driving Costs Aaa Newsroom

Infrastructure Package Includes Vehicle Mileage Tax Program

Aaa S Your Driving Costs Aaa Exchange

Business Mileage Deduction 101 How To Calculate Mileage For Taxes