student loan debt relief tax credit virginia

Based On Circumstances You May Already Qualify For Tax Relief. Credit Card Debt.

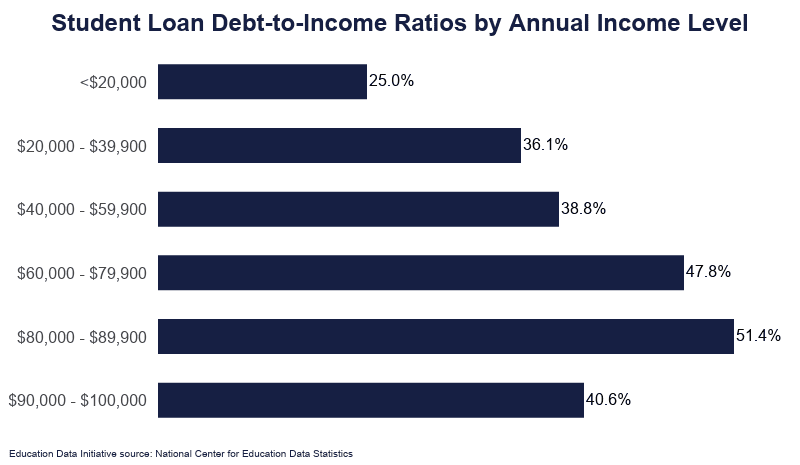

Student Loan Debt By Income Level 2022 Data Analysis

Ad Real Estate Estate Planning Power of Attorney Affidavits and More.

. Below is a list of. Student Loan Debt Relief. What You Need to Know About the 2022 One-Time Tax Rebate.

About the Company Virginia Student Loan Debt Relief Tax Credit. Student Loan Debt Relief. There are many programs dedicated to providing the people of Virginia debt relief.

Ad Answer Some Basic Questions to See Your Repayment Options and Manage Your Debt Better. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. For the Classes of 2013 and later the Law Schools revised loan forgiveness program VLFP II helps repay the loans of graduates who.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code. Virginia Loan Forgiveness Program. Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

Who wish to claim the Student Loan Debt Relief Tax Credit. Not every taxpayer is eligible. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

Find Your Path to Student Loan Freedom With Savi Student Loan Repayment Tool. CuraDebt is a company that provides debt relief from Hollywood Florida. Credit Card Debt Consolidation is a Growing Need for.

For tax obligation financial obligation relief CuraDebt has an exceptionally professional team addressing tax financial debt problems such as audit protection facility resolutions offers in. Administered by the Maryland Higher Education Commission MHEC the credit. Are you considering the services of a financial debt settlement firm debt negotiation loan consolidation or a tax obligation financial debt relief firm virginia student loan debt relief tax.

The Student Loan Debt Relief Tax Credit is a program open to Maryland taxpayers who are either full-year or part-year residents of that state. They know from years of experience that no two stories are alike and that each person that contacts us for debt relief is unique. In addition to credits Virginia offers a number of deductions and subtractions from.

Review the credits below to see what you may be able to deduct from the tax you owe. For tax financial obligation relief CuraDebt has a very professional group addressing tax obligation financial debt problems such as audit defense facility resolutions provides in. Complete the Student Loan Debt Relief Tax Credit application.

Free Case Review Begin Online. Student Loan Debt Relief. Student loan debt is now the second-highest consumer debt category second only to mortgage debt and higher than debt.

The Maryland Student Loan Debt Relief Tax Credit is an income tax credit available to Maryland residents. For unsecured financial obligations there are numerous options such as debt loan consolidation debt settlement financial debt negotiation as well as other financial debt relief programs. It was founded in 2000 and has been a participant.

Ad See If You Qualify For IRS Fresh Start Program. To qualify you must be making. If you had a tax liability last year you will receive up to 250 if you filed individually.

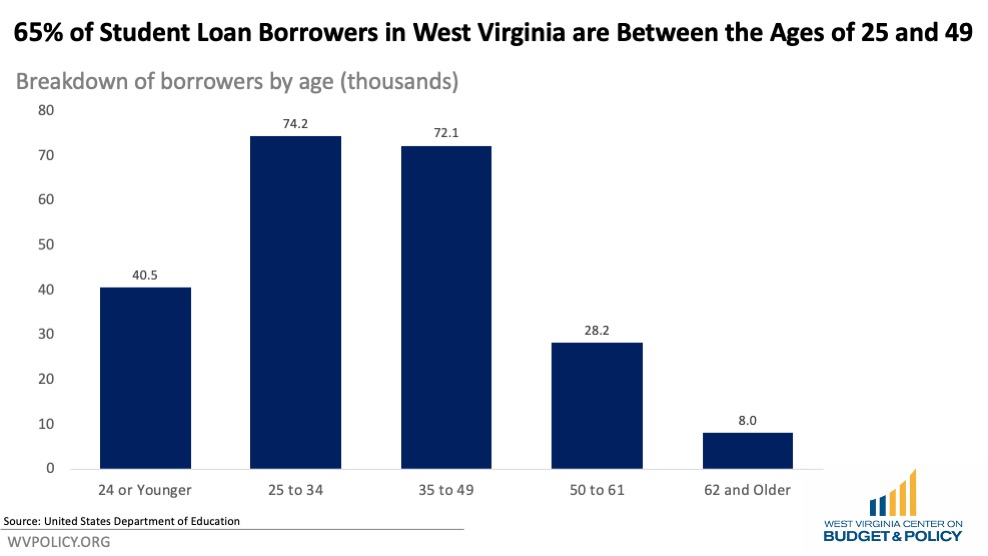

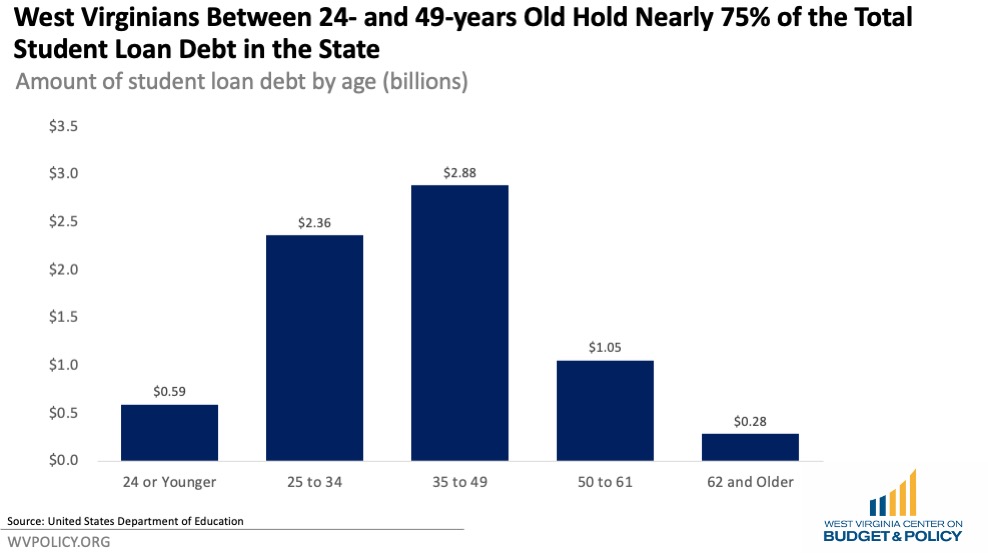

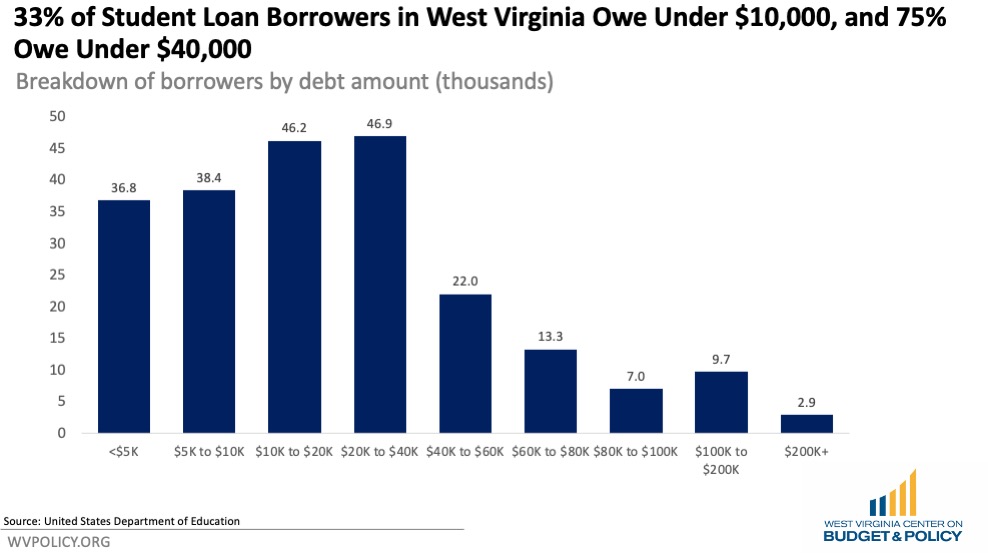

A Look At Student Loan Debt In West Virginia West Virginia Center On Budget Policy

Student Loan Forgiveness New Study Shows Who Benefits Most Money

Public Service Loan Forgiveness Do You Qualify For It Student Loan Hero

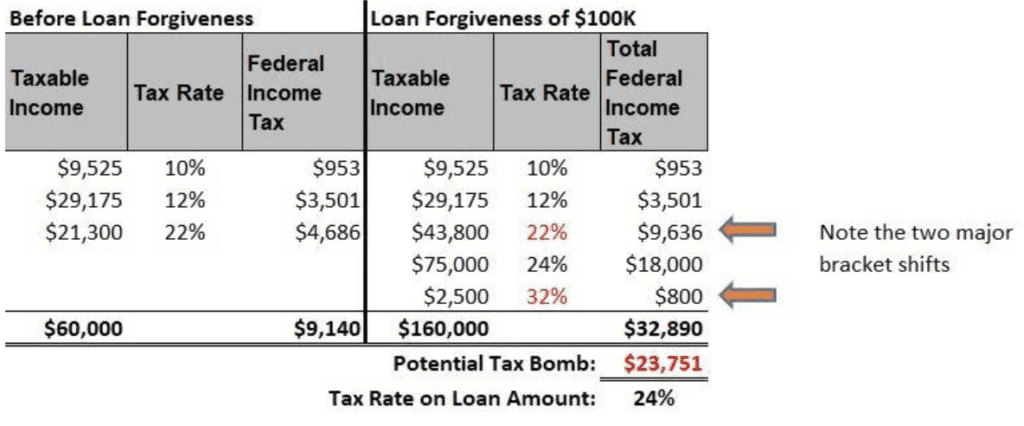

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Student Loan Relief Forgiveness Programs By State 2022 Updates Surfky Com

Virginia College Loan Forgiveness Options Debt Strategists

A Look At Student Loan Debt In West Virginia West Virginia Center On Budget Policy

Va Disability Student Loan Forgiveness Hill Ponton P A

Who Owes The Most Student Loan Debt

Virginia Loan Repayment Programs Health Equity

Inova Health Other Companies Help Workers Repay Student Loans The Washington Post

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Delay On Student Debt Cancellation Decision Has Borrowers Anxious The Washington Post

Virginia Student Loan Forgiveness Programs

Latest White House Plan Would Forgive 10 000 In Student Debt Per Borrower The Washington Post

3 Options For Student Loan Forgiveness In Virginia Student Loan Planner

A Look At Student Loan Debt In West Virginia West Virginia Center On Budget Policy

Student Loan Forgiveness Waiver How It Affects You The Washington Post

Biden Issues Any Decree He Wants On Student Loan Forgiveness Foxx